common problem

- Personal purchase of Japanese goods

-

When individuals purchase foreign goods, they must apply for real-name authentication (EZWAY) in accordance with the law.

Our customer service staff will confirm the real-name registration with you before shipping.Verified

One mobile phone number can only be bound to one ID number.

(1) Introduction:

Goods (including general international shipping and cross-border online shopping) must be declared to the customs as long as they are imported into Taiwan. When the importer appoints a customs declaration operator to declare imported goods to the customs, the relevant authorization documents of the customs declaration operator should be provided. However, paper customs declaration authorization documents are not valid. Insufficient protection of people’s personal information also affects the timeliness of customs clearance of express cargo. Therefore, in order to provide the public with more convenient and safer customs clearance services, the customs has relaxed the regulations in 107 years (for details, please refer to Article 17, Item 3, of the Customs Clearance Measures for Air Express Cargo), and relaxed the rules for imported express delivery. The paper customs declaration appointment for simple declaration can be processed online through the real-name authentication APP. People can use the APP "EZ WAY" to complete the real-name authentication process of binding their personal identity card number or residence permit number with their mobile phone number. Complete the App's real-name authentication to simplify the issuance of paper letters of authorization, and then simplify the import of express delivery goods. There is no need to provide your ID number to logistics operators to ensure the security of personal data.

In order to implement the customs declaration authorization regulations, the customs will check the customs declaration appointment for express cargo through the customs clearance system starting from May 16, 2020. If the customs declaration operator fails to confirm the declaration of the importer’s customs declaration authorization document and the declared importer has not been authenticated in real name Otherwise, the customs declaration will not be accepted until corrections are made.(2) Operation instructions (App "EZ WAY Yiliwei" registration and appointment confirmation)

The registration process of App "EZ WAY" is very fast. You only need to fill in personal information and select whether it is your own mobile phone number. If it is your own mobile phone number, the "telecommunications authentication" method will be used first; if it is not your own mobile phone number (or If telecommunications authentication fails), the "SMS authentication" mode will be adopted.

After the registration is completed, the consignee's name and mobile phone number declared by the customs declaration operator during subsequent customs declarations are verified by the customs clearance system as real-name authentication. The customs will promote the customs declaration information to the public through the App "EZ WAY". The public can After checking that the customs declaration information is correct, confirm it with one finger to replace the original paper copy.

Registration (complete registration and real name at the same time) operation:

Download and install the App "EZ WAY": Please go to the app store to download and install the App "EZ WAY".

- iOS link URL and QR code:

https://reurl.cc/Mvd5Nv - Android

https://reurl.cc/ZO73N6

The following information is reproduced from the Customs Administration of the Ministry of Finance. For detailed information, please go to the website of the Ministry of Finance.

- iOS link URL and QR code:

- custom declaration

-

Import process

1. Basic steps:

(1) Receipt → (2) Assessment → (3) Inspection → (4) Taxation → (5) Release

(Those exempt from inspection will skip step (3); for some goods, step (3) will be moved to the end)

2. Those who are not connected: After submitting the import declaration and related documents to the customs, they can key them into the computer. The subsequent procedures are the same as those who are connected.

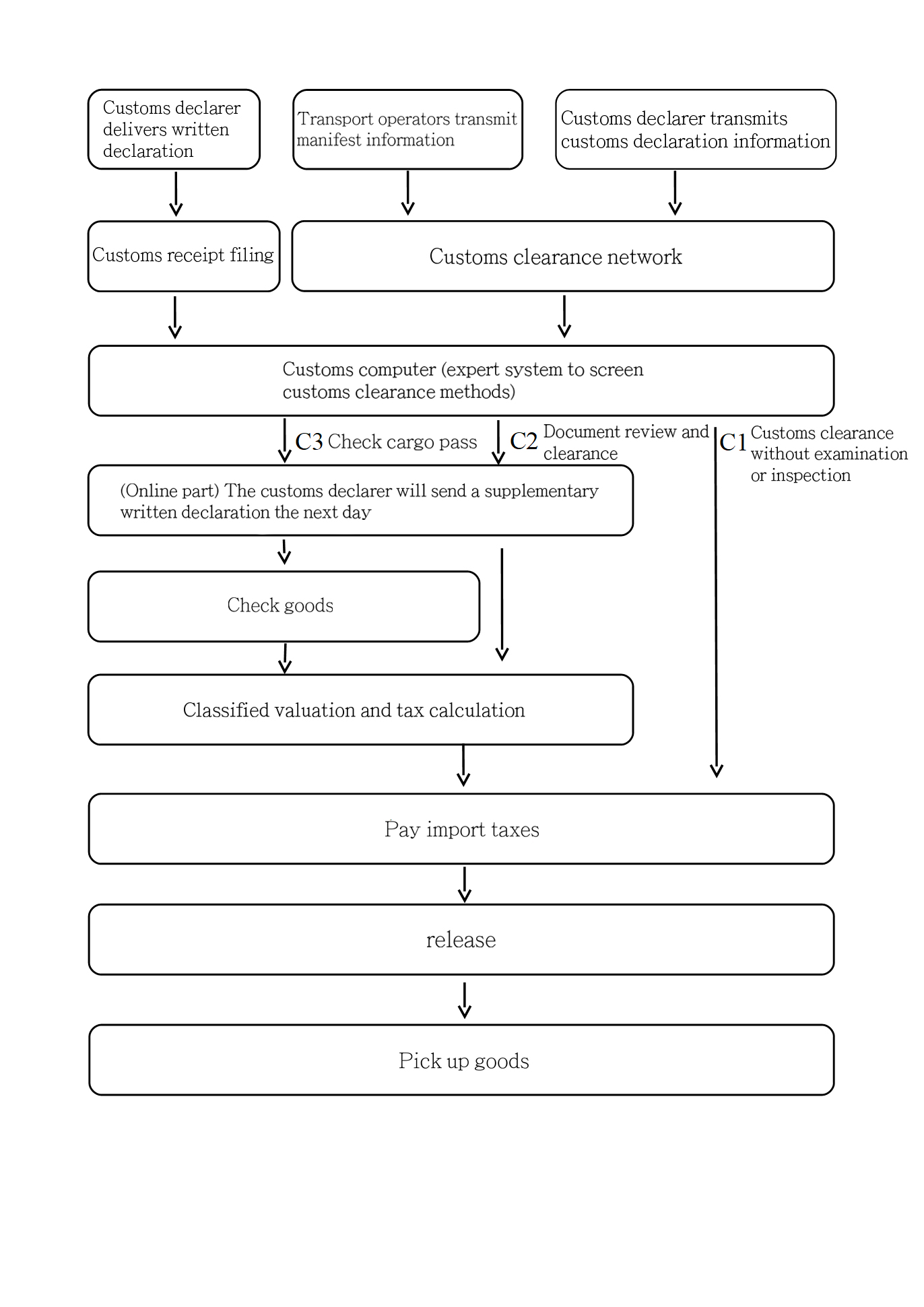

3. Customs clearance flow chart for imported goods

4. Complete description of the customs clearance flow chart for imported goods:

(1) Online customs declaration: Customs declarers use computers to transmit import declaration information to the customs through the customs clearance network, or use the Internet to declare directly to the customs computer.

(2) Off-line customs declaration: The customs declarer directly submits a written declaration to the customs, and the customs personnel receive the document and key it.

(3) The transportation industry transmits import manifests.

(4) Customs computer expert system screens customs clearance methods

1. For those certified as C1, written documents will be exempted from review and the goods will be released without inspection and tax payment.

2. If it is assessed as C2, the customs declarer shall submit a written declaration and related documents to the customs "before the end of office hours on the next day" according to the computer connection notification. After the customs collects the bill and completes the tax assessment operation, the customs declarer will pay the tax or release it through customs in accordance with the method of releasing tax first and then paying tax later.

3. If it is assessed as C3, the customs declarer must submit a written declaration and related documents "before the end of office hours on the next day" according to the computer connection notification. After the customs collects the bill, inspects the goods and completes the tax assessment work, the customs declarer will pay Customs clearance or release based on customs clearance first and tax later.

(Note: C3 goods inspection and clearance cases are divided into two methods: first inspection and then estimation and first estimation and then inspection. For C3 cases, the inspection is carried out first, and then the tax estimation and tax payment release operations are carried out after the inspection. First estimation and then inspection. For inspection type C3 cases, separate tax estimation and tax payment operations must be carried out first, and then inspection and release, such as ship (machine) edge inspection or warehouse inspection and release, etc.)

(5) Signing and examination operations: According to the import regulations, if the documents approved by the signing and examining authority are required to be imported, the customs declarer must go through the application procedures with the signing and examining authority. After being reviewed by the signing and examining authority, the review results will be sent to the convenient trade e-commerce website. Notify customs and business operators that if the signing and approval documents have not yet been implemented electronically, customs declarers must still submit written approval documents to the customs.

(6) Issuance of tax bill and tax payment: The customs issues a tax payment certificate (or the customs declarer prints it on his own) and informs the taxpayer, who then pays the tax bill to a bank or electronically transfers it through a financial company (bank) and Customs clearance network transmission customs.

(7) Release notification: The customs will transmit the release information to the customs declarer and warehouse.

(8) Pick up the goods: The customs declarer goes to the warehouse to pick up the goods with the delivery documents.

Inquiry unit: Business Group Assessment Course 1 and 2

Contact number: (03)383-4265 extension 206, 226

The above is Taiwan’s official customs declaration import process for reference only. Products imported for sale in the country must abide by local regulations.

Please contact local government agencies first, or check relevant regulations on food, electronic products, radio frequency equipment, medical equipment, etc. by yourself.

If you have any questions, please feel free to contact us. - Air freight service

-

Our company provides ultra-low-cost air freight services from Japan to Taiwan at 200 yuan per kilogram. If the weight is less than 5 kilograms, additional local home delivery fees will be charged.

For urgent items, Japan Post EMS (delivery in about 4 to 5 days) is also available. Please contact our customer service for details.

Length + width + height = goods within 150cm and weight within 30kg

Air freight services mainly provide fast arrival services for small quantities of goods purchased by individuals.

Examples: food gift boxes, small home appliances, fashion clothing, jewelry, etc.

If you use air freight as a means of transportation for import in your name, you must log in to EZWAY for real-name authentication.

※Please note that air transport cannot transport any dangerous goods and prohibited goods, such as: patent medicines, battery-containing products, alcohol (perfume), military supplies, wildlife products, etc. Please contact our company's customer service staff for details. - Shipping services

-

Our company provides sea shipping services from Japan to Taiwan, and Japan Post sea shipping is also available.

Length + width + height = goods within 150cm and weight within 30kg

Shipping services mainly provide large quantities of goods and large-scale goods.

Example: furniture, car wheels, tires, etc.

If you use sea transportation as a means of transportation for import in your own name, you must log in to EZWAY for real-name authentication.

※Please note that sea freight cannot transport any food, cosmeceuticals, battery-containing products, alcohol (perfume), massage chairs, etc. For details, please contact our customer service staff.